Back

13 Jan 2020

Crude Oil Futures: door open for a move lower

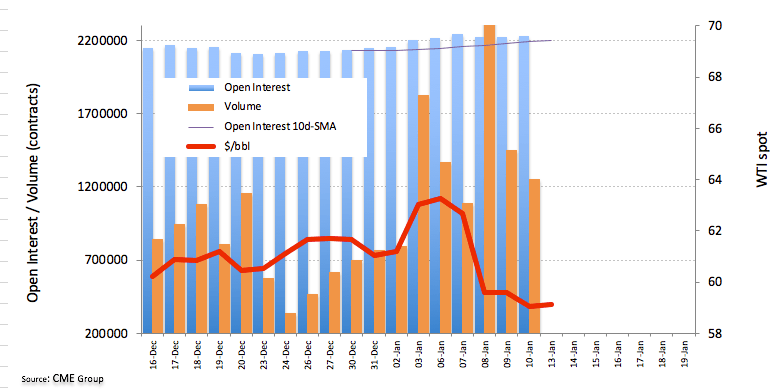

CME Group’s first estimates of Crude Oil futures markets noted traders added nearly 7K contracts to their open interest positions at the end of last week, recording the second build in a row. On the opposite side, volume went down by around 199.7K contracts.

WTI is so far supported by the $59.00 mark

WTI was rejected from the vicinity of the $66.00 mark and the descent has extended to the sub-$59.00 in late last week. Diminishing tensions in the Middle East were the exclusive driver behind the sharp decline in crude oil prices in past sessions. That said, rising open interest hints at the probability that the sell-off could extend further in the near-term. In this regard, the key 200-day SMA emerges at $57.76.